My guess is that Equifax wanted to change, not because of the new number at all, but because changing the numbers gave them an excuse to change those band names and ranges. I have asked Equifax this – so far they haven’t replied, so the following are my thoughts.ħ00 always seemed like a strange number, so perhaps Equifax just wanted a more sensible one? But making this sort of change is going to be confusing for customers during the transition, so there probably has to be a better reason than that. Without careful consideration and planning there could be a risk of confusing consumers by suggesting the scores are the same if the meanings are not.” Why did Equifax do this? “If, in the future we felt there was a potential benefit in changing the current scoring model we would look into that but it’s important that any changes take into account the broader discrepancies in how different credit reference agencies and lenders use the data provided. I asked TransUnion if they had any plans to change from their current 710 maximum.

#CREDIT SCORE RANGE EQUIFAX FREE#

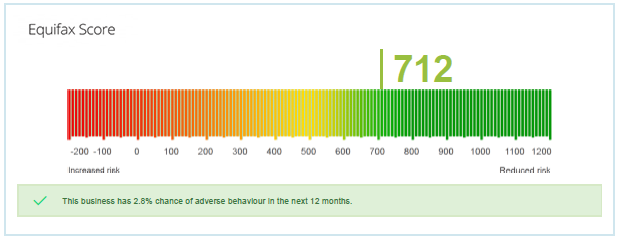

See The three best ways to check your credit ratings for my recommendations – there are free reports for each of the CRAs. If you want to be sure what your credit record looks like, you have to check reports covering all three CRAs. So you could have a good score with one CRA and a poor one with another. But many creditors don’t report to all three CRAs. The most important factor in calculating your credit score is your credit history. You might think that now Equifax’s maximum is almost the same as Experian, this means that your Experian and Equifax scores will be almost the same so you only have to check one of them… but that is wrong. It has always been confusing that the three major Credit Reference Agencies (CRAs) each assess your credit score on a scale with a different maximum: Equifax could have called them “Pants” and “Awesome” and lenders would not change what they think of your credit record. the previous Excellent band has been divided into two, so some people will see their rating “drop” to Very Good.īut these are just labels… once again they don’t have any impact on whether you are likely to be accepted or rejected for credit.the new Good band is much larger than the old one, so more people will be in it.no-one has a Very Poor credit score anymore and most people who were rated Poor before are now Fair.It isn’t easy to see from that at a glance, but some of the changes in the bands are large and they haven’t all been caused by the change to 0-1000 scoring. This table shows the old Equifax guidelines compared to the new ones: The numbers would have to change for the new 0-1000 scale, but Equifax has also decided to change the band names to Poor – Fair – Good – Very good – Excellent. Equifax now puts scores into different bandsĮquifax used to use Very poor – Poor – Fair – Good – Excellent to describe your credit rating. Your score may look higher, but you’re not more likely to be accepted for new credit by lenders. Some lenders use the Equifax data and some of them get Equifax to calculate a score for them, so the credit history Equifax holds is important for your chance of getting a loan or a credit card.īut the scores lenders use are not the ones you can see, so the fact your headline number has changed won’t affect whether your credit application is approved. Lenders don’t use these scores that Equifax calculates for you at all. If you had 7/10 for your last piece and next get 14/20 your work isn’t any better.

It like a teacher saying “ I normally mark your project out of 10, but from now on I am going to mark out of 20 instead”. You are just being shown a different number. You might think a higher number sounds good – but it doesn’t mean your credit history has improved. How will the score changing affect you? Your credit record hasn’t changed – a higher score isn’t better Many problems with credit reporting in the UK.Equifax now puts scores into different bands.Your credit record hasn’t changed – a higher score isn’t better.How will the score changing affect you?.

0 kommentar(er)

0 kommentar(er)